A storm has been brewing, not only in social and mainstream media, but in Parliament too, calling for the government to approve the I-Citra 10k one-off withdrawal for depositors who have enough funds in their EPF savings and are in dire need of capital injection to extend their lifeline.

The pandemic and the various Movement Control Orders (MCO), plus the ensuing natural disaster like the recent massive floods, have brought about a lot of hardships to Malaysians who were afflicted with unemployment, loss of business income and for some, the demise of breadwinners in their households. Heartaches which many were not prepared for.

Cases of suicide as a result of emotional depression and extreme despair have been on the rise since not only when the pandemic first hit our shores in 2020, but also from the time the Pakatan Harapan government took over in May 2018 and almost ruined the country with their inefficient fiscal management. As up to May 2021, statistics showed that there were three daily suicide cases per year then.

Although the government had given out a number of aid and stimulus packages to the various categories of society, especially the B40 groups, quite a number of people have found these were insufficient to cushion them from the never-ending losses. For some of these aid packages, the amounts, usually paid out in a few tranches making the individual payouts seem minimal, what they received was never enough.

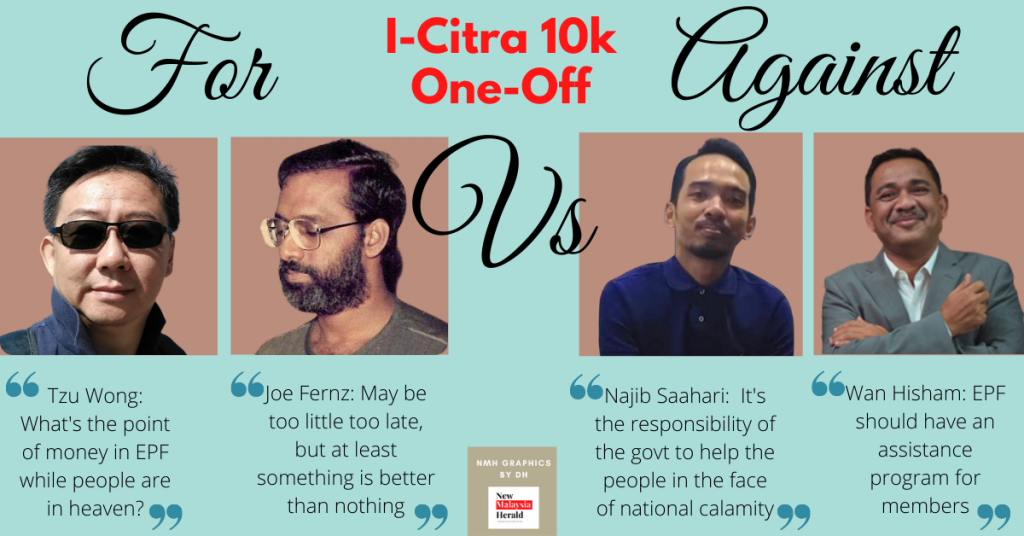

We asked a number of people their thoughts about this EPF one-off 10k withdrawal proposal.

Najib Saahari, an entrepreneur who is well-versed in the financial sector both internationally and domestically, does not agree that depositors should withdraw the lump sum from their retirement funds in order to survive because he feels that it is the responsibility of the government to provide the help needed, especially during times of national calamity.

“If the government can’t help us due to fiscal issues, etc, then there is no choice but EPF has to allow for the withdrawals to fund our emergency needs since the government has failed to provide the support.

“Not all EPF assets are illiquid assets that can’t be quickly converted to cash. Some of these have been placed in cash equivalent assets, like placing them in the money market so these can be easily liquidated to meet the current demands. Definitely a no-issue,” said Najib.

He added that even if there’s a need to liquidate assets to meet the shortfall, the government can always instruct BNM to swap cash with assets and EPF buy it back later. No assets have to be liquidated, capital market still intact because there’s no selling pressure and EPF can meet the necessary demands.

“EPF is a cashflow positive entity. Every month there are billions flowing in, they can use that money to buy back the assets,” he added.

Another entrepreneur, Wan Norhishamudin Osman, founder of a gold trading company here, feels that EPF should probably extend beyond its current job scope.

“Established in 1951, EPF helps the Malaysian workforce to save for their retirement in accordance with the Employees Provident Fund Act 1991. In principle, I am against the idea of the 10k one-off withdrawal as this will defeat the purpose of setting up EPF in the first place.

“However, rather than giving a blanket approval for a 10k one-off withdrawal, EPF should have an assistance program as its working module, just like the computer scheme before. EPF should assist its members who are in need, and are qualified for the assistance program.

“Make it hard to withdraw, but not impossible, only then it will be meaningful and not open to abuse,” Wan Hisham added.

For long time Borneo watcher and legal scholar (jurist) Joe Fernandez however, the I-Citra RM10K from EPF may be too little too late, but at least something is better than nothing. “It may be cliche, but better late than never,” he said.

“Having said that, if contributors don’t have that much money in their account, perhaps EPF can consider paying out the said amount from its own resources. I don’t know what ‘own resources’ EPF has, but if it dips into these, assuming that they have access to such funds, it means not touching money in contributors’ accounts to pay out the proposed 1-Citra RM10K,” added Fernandez who has also been a journalist for many decades and blogs on current and legal issues.

“What is the point of having retirement when some can’t even get through this present moment?” asked Tzu P Wong, an entrepreneur based in Sabah. What’s the point of “money in EPF, but people in heaven?”

“We should actually provide maybe three chances to allow members to withdraw up to certain percentages of their balance in account 1 for use in whatever personal emergency they are afflicted with. Because people do suffer ups and downs in life, and some people may not be good at handling their negativities in life and end up suffering depression and are even traumatised by the setbacks in their life that some resort to suicide. If we could give people a chance to use some of their retirement funds before it is due to help them get through their down moments, it would be a better thing for the whole society in general,” Wong added.

We also spoke to a former EPF senior official on his thoughts about the 10k withdrawal. He said with the various withdrawals: i-Lestari, i-Sinar and i-Citra, these were reported to have totaled RM101 billion which were distributed across 7.4m members. These three schemes have inevitably led to 6.1m members now having less than RM10k in their EPF accounts, of which 3.6m have less than 1k, leaving them vulnerable and unprotected for their retirement.

He added that bumiputera members made up 78% or more than 3/4 of the withdrawal applicants. As a result, 4.4m or 54% of bumi members now have less than 10k, and 2.0m or 25% have less than 1k. The bottom 40% (about 5.0m members) saw their savings drop by 38% to just RM8b translating into a median savings balance of RM1,005. The middle 40% also suffered a decline of 18% to RM115b or a median balance of RM24,995. Only the top 20% of members aged below 55 saw an increase in savings, but this translates to a median of RM152,043 or equivalent, to just RM633 per month for 20 years.

He said that looking at the above statistics, he is not in favor of any more withdrawal schemes as EPF savings are meant for retirement. Nevertheless, the issue is putting food on the table now, or save for retirement. It is not an easy choice.

There you have it people, many have voiced their thoughts, anger, disappointment and even disgust about their current financial situation. People would not have to beg to withdraw from their retirement fund if the last three governments had done their part to cushion the various blows.

If you’re still asking for that 10k one-off withdrawal to be approved, there is a petition going around. If you want to show your support for this cause, you may log in here. – New Malaysia Herald

Datin Hasnah is the co-founder and CEO of New Malaysia Herald based in Kuala Lumpur, Malaysia.

With an extensive background in mass communication and journalism, she works on building up New Malaysia Herald and it’s partner sites. A tireless and passionate evangalist, she champions autism studies and support groups.

Datin Hasnah is also the Editor in Chief of New Malaysia Herald.

Facebook Comments