The talk that BlackRock is involved in the buying of Malaysia Airports Holding Berhad’s shares got many restless on their posterior. Why the uneasiness?

Lately, there has been a lot of buzz about BlackRock. No, it’s not a new heavy metal genre that mixes black metal and hard rock. It’s worse than that. It’s a gigantic investment company that is basically, indirectly, impacting our livelihood, our health, and potentially the next government we are going to foolishly choose. Again.

I am exaggerating, of course. Our lives are actually controlled by social media Likes, cat videos, and food porn on Instagram. Not some investment companies. Anyway, let me start with my usual film quote.

BlackRock? Who are those guys?

“Who are those guys?” is a famous line from the classic 1968 Hollywood flick Butch Cassidy and Sundance Kid, where the infamous robbers of the title are chased by these dark, mysterious posse of horsemen from distance who finally finish off the legendary bandits at the climax of the bloody shootout. What is then, BlackRock, that seemed to be purposefully named to strike fear upon hostile investors, greedy businessmen, and corrupt politicians (or all three in one)?

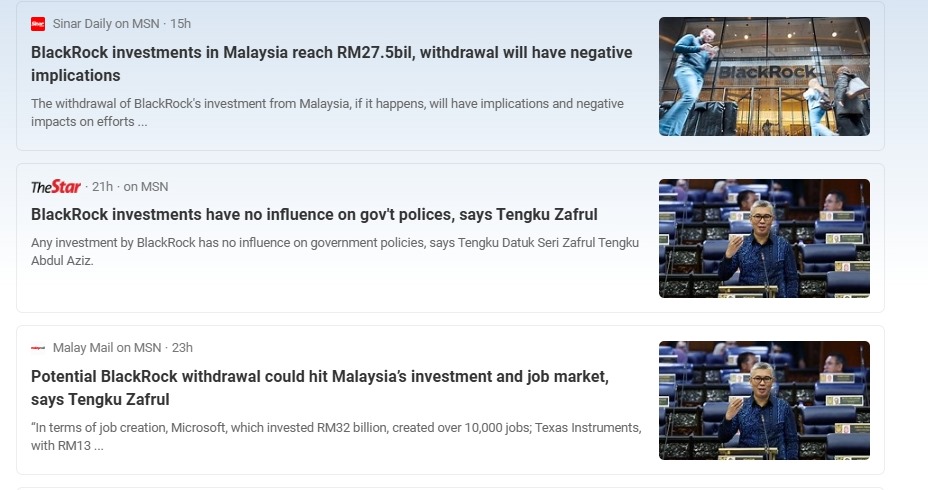

In fact, it is not until recently that Malaysians in general have heard that name, the desas desus (words in the wind, so to speak), about the mysterious investment entity. However, this information is now publicly available. When it was reported that Gateway Development Alliance (GDA) announced an offer to acquire Malaysia Airports Holdings Bhd (MAHB) on 15 May, some folks got frantic. GDA is part of Global Infrastructure Partners (GIP). GIP, in turn, is in the midst of an acquisition by BlackRock Inc.

You can read more about GIP’s intent here, where a news agency conducted an “interview” with GIP’s head of transport, Phil Iley, in what looks like an emailed Q&A possibly responded by the company’s PR agency, where the business lingo, spread like cheap margarine, filled paragraphs that look like the parts we tend to skip before signing “I agree.”

Not to mention, we have already spoken about Malaysia Airlines’ somewhat openness in allowing dubious airport lounge operators with its affiliation with El Al Israeli Airlines that would also easily grant the genocide loving country’s intelligence agencies access into passenger database. Among others.

The Opposition’s Opposition

Naturally, there are oppositions. By whom? The opposition, of course.

“The Prime Minister did not explain to the public that according to a statement by GIP a few days ago, the company said that it will play a role as a technical partner and be involved in airport management,” grumbled Wan Ahmad Fayhsal Wan Ahmad Kamal, Machang MP of the opposition pact, Perikatan Nasional.

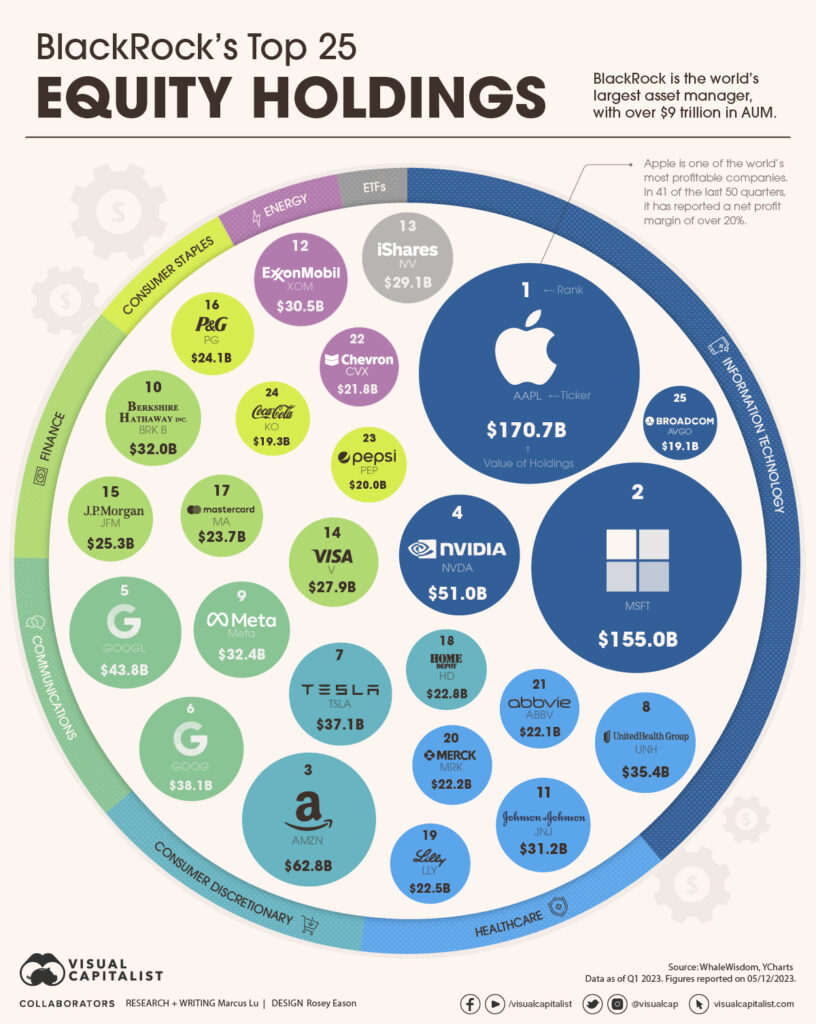

Wan Fayhsal and some others mentioned in the news have reasons to reject the offer. For one, the asset management company is a collosus that can swallow a country like an open-mouthed whale going head-on against a school of fish. I mean, look at the size the number crunchers are spitting out.

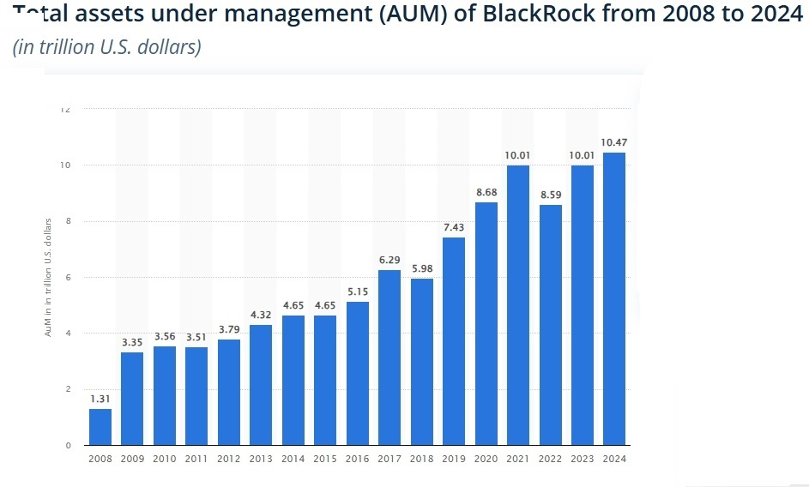

According to this report, “As of the first quarter of 2024, the New York City base… BlackRock had total assets under management (AUM) of around 10.5 trillion U.S. dollars. This compares to 8.59 trillion U.S. dollars of AUM as of 2022. The total assets under management of BlackRock Inc. more than doubled between 2016 and 2024, reaching a value that makes them the world’s largest asset management company.”

Alright, more jaw-dropping time: Here’s a video clip of a Scandinavian gal explaining in detail what BlackRock owns or has a considerable share of throughout the globe. Her nonchalance can be disconcerting, but really check her—I mean, the numbers out.

While In Malaysia

Now, as far as our country is concerned, BlackRock’s Equity Fund is already capitalised at USD 279,011,893 (as of June 25th, 2024), holding equity in hundreds of Malaysian corporations, totaling around RM24.7b, and among them are CIMB Holdings, Tenaga Nasional, and Petronas, the latter of which paid RM40b in dividends to the government in 2023 (I recommend Minyak Cap Kapak, which still works).

Some may rejoice, especially those who take masochistic pleasure in seeing our country slowly go through another round of colonisation. Yet, there is another reason that should be concerning, especially for those who believe that not eating sausage McMuffin can help stop genocide in Gaza.

The Greenwashing

For one, we have established that the company can just buy the entire nation out on the open market. But its complicity with the genocide in Gaza is something that concerns many. All these, while BlackRock takes pleasure in championing environmental, social, and corporate governance (ESG) on one side.

Which it does so well while also profiting from fossil fuels and war. It never shied from bragging that it is the world’s largest investor in fossil fuels, where BlackRock holds stakes of about 9% in Philips 66 and Occidental Petroleum; 8% in Valero Energy and ConocoPhillips; and 6% in ExxonMobil. Overall, the money manager has nearly $260 billion invested in fossil fuel companies around the world, including $91 billion in Texas. Therefore, we can surmise that their ongoing efforts in ESG are nothing but pure greenwashing at best.

It is also no surprise that its transplanted, battery-operated conscience may have been involved, as the company also plays a huge role in the pharma industry, especially in the US.

BlackRock, alongside its kindred spirits Vanguard and State Street, owns shares in the top three pharmaceutical companies in the US: Pfizer, Johnson & Johnson, and Merck. And every year, BlackRock and its ilks, Vanguard, and State Street receive billions of dollars from these investments. Here’s a look at the market capitalisation of these companies in the pharma stratosphere:

Aside: Not related, but I bereave the passing of the great Hollywood film actor Donald Sutherland, who once played a guy who starts fires so that it can give something for the firemen to do (Backdraft, 1991). Oh wait, this has nothing to do with pharmaceutical companies and the recent trend of, err, trendy new viruses and diseases. End of aside.

The Gaza Connection

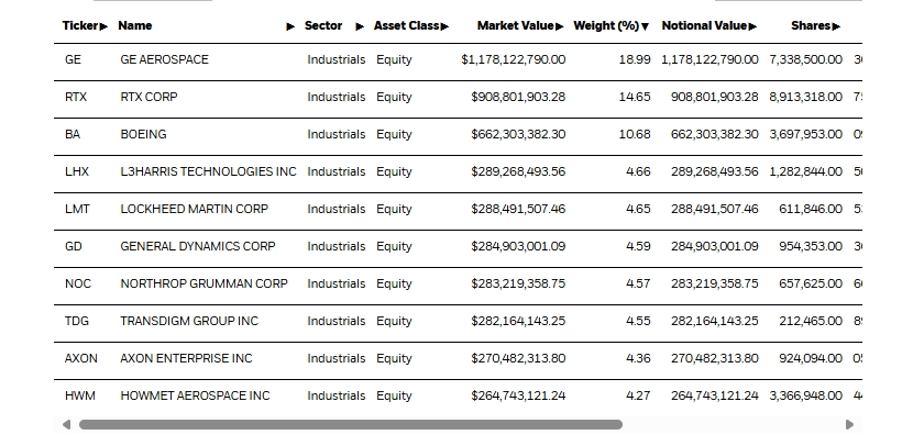

Then, believe it or not, with all that bleeding conscience, BlackRock has shares in defence companies like Lockheed Martin Corp., Boeing, Raytheon Technologies Corp., General Dynamics, and Northrop Grumman Corp., which are arming the terrorist state of Israel to the teeth. Here’s from the horse’s mouth: its involvement with the companies that produce death machines:

It’s Already Here

Thus, now there is a fantastic chance that they are going to make an inroad into Malaysia, having already gotten one foot through the door through its investment in more than 100 companies in the country (with a total amount of investment of USD 4.3 billion or RM 24.7 billion). If the MAHB deal is in the bag, it is going to put the other foot in.

Sure, the bigger the investment, the better the economy and the job opportunities, blah, blah, blah. If that is the case, then it is wise for the entire nation to also sit and, like the majority of other nations, watch the cleansing of Gazans enter its climax stage.

What’s the point of the country leader announcing that we are not going to sit down and do nothing about Gaza on one side and, on the other side, not only allowing this foreign entity to slowly gorge the businesses in the country but also welcoming one of the facilitators of genocide to waltz in through another door?

Colonisation

You see, colonisation has now evolved into a different animal. Only the uncivilised go for military incursions (cough! Cough! USA! Cough! Cough). Also, it’s a question of sovereignity. Therefore, the ownership of the country. Is Prime Minister Anwar intending to finish what he sought out to do back in the 90s with the IMF?

Just to refresh lots of convulsed minds, back when we had an economic crisis going on in 1997, Anwar, as the then deputy Prime Minister, was pushing for aid from the International Monetary Fund. It was already noted then that critics of the IMF pointed out that the institution pushed for too much reform within too little time. (Latest: He is refuting some of the stuff, in apparently a lengthy outburst).

And In Indonesia

This happened to Indonesia, which, at the time, had earlier taken up the IMF’s bailout package, and the country erupted in riots.

Thankfully, the then prime minister, the then Datuk Seri Dr (pre-Tun) Mahathir Mohamad, whose brain was yet to be taken over by complaint bureau aliens, did not budge to Anwar’s idea, knowing well that allowing the IMF in would mean his own financial interests in various entities would have to do a striptease.

Some of you may say, MAHB is just contemplating, nothing is confirmed yet: So, why are you scaring us with some financial Godzilla story? Well, way back in 1600, the Brits started East Indian Company just to, you know, do business in a certain sub-continent. And all hell broke loose. – NMH

A movie buff, as opposed to film connoisseur or aficionado, because the last two words are hard to spell, Rakesh has been in the field of writing for more than two decades and hopes that one-day movie “buff”ing is lucrative enough to afford him a Batmobile, the Michael Keaton one.

Facebook Comments