Malaysia Airlines, once a symbol of excellence in the airline industry, faced a significant setback when it encountered an in-flight catering debacle that garnered global attention. But it is not just about poor handling of crisis communication, there seems to be a sinister plot to oust genuine bumiputra service providers with proven track records and can offer rates more competitive than other players with questionable corporate backgrounds. NMH’s Hasnah Rahman has the story …

Let’s admit it, if you talk about Malaysia Airlines some 20 years ago, what comes to mind was Malaysian hospitality via graceful ladies in batik kebaya serving warm meals with a smile on their faces.

Fast forward 10 years later, the airline was plagued by two major incidents that have sent the airline reeling: Missing flight MH 370 and the downing of MH 17 – all during the same year, 2014.

Also Read:-

New MH370 Research Confirmed With Updated Tracking Technology

100 Reasons Why Najib Should Be Called Malaysia’s Transformer

Malaysia Airlines – New Lounge Operator Raises Security Concerns

Now, some nine years later, the food in the sky incident faced by the airline has shed light on the critical importance of maintaining high standards in airline services and the complexities of crisis management in the digital age.

Let us now focus on the parties involved in the issues pertaining to the contracts to provide in-flight and airport lounge services, specifically at KLIA.

The In-flight Meal Players

Traditionally, there were only two parties providing inflight catering from KLIA -1 (premium airlines) which were Brahim’s Food Services and Pos Aviation (a subsidiary of POS Malaysia).

As for the airport lounge sector at KLIA, the Golden Lounge at Satellite, Regional and Domestic were entirely catered by Mas Awana Sdn Bhd (MAB-60%, Evergreen – 40%).

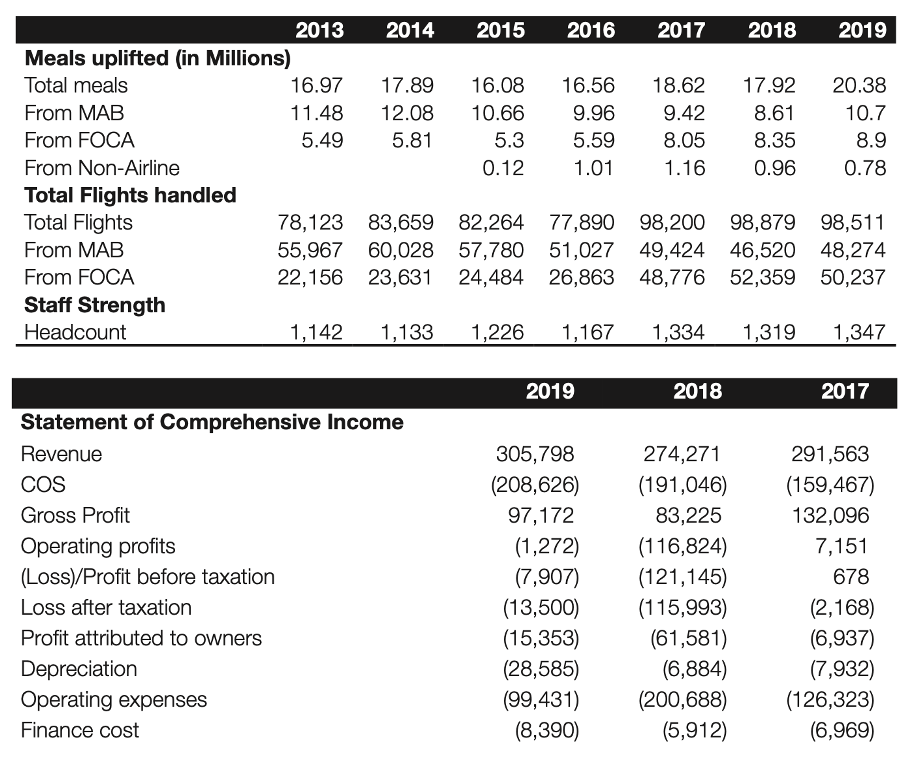

The entire inflight catering and Golden Lounge business was estimated at over RM500 million per annum in 2019. In 2023, due to escalation of costs and MYR:USD unfavorable exchange rate to Malaysia, the 2019 estimate has increased to RM800 million and growing.

The In-Flight Catering Biz

In 2003, LSG-Brahims undertook the acquisition of Mas Catering Sdn Bhd for RM170 million cash & RM240 million in accumulated losses in the company (Brahim’s absorbed the loss) – adding up to RM410 million – in exchange for a 25-year contractual commitment.

Fast forward to 2013, Brahim’s acquired a 49% stake in LSG-Brahim’s for RM135 million.

However, the landscape shifted in 2015 following the restructuring efforts outlined in the Malaysia Airlines Berhad (MAB) restructuring plan of 2014. This move prompted the premature termination of Brahim’s contractual arrangement, which had initially been set for a 12-year duration. Regrettably, no compensation was extended in light of this development.

Subsequently, in 2015, Malaysia Airlines revisited the contract, offering Brahim’s the opportunity to re-engage, albeit under significantly revised terms. These revised terms included a 40% reduction in pricing across all facets of the agreement, accompanied by a modified five plus five (5+5)-year contract duration.

Notably, Malaysia Airlines had a pre-existing debt owed to Brahim’s, amounting to RM75 million for unpaid meals. This debt, however, was written off, as it pertained to the previous Malaysia Airlines entity (MAS) and not the restructured entity (MAB).

Terminated

In summary, Brahim’s expended a total of RM410 million (comprising RM170 million & RM210 million accumulated losses in MAS Airline Catering) for a 70% stake in Mas Catering to secure the 25-year contract for Malaysia Airlines Inflight Catering. Twelve years into this commitment, the contract was unexpectedly terminated due to the restructuring process that transformed Malaysia Airlines from MAS to MAB.

During the negotiations that followed, Brahim’s Food Services, joint venture with MAB holding 30% was confronted with the following conditions:

- A 40% reduction in pricing across all contract elements.

- The write-off of a RM75 million debt owed by the previous Malaysia Airlines entity.

- The acceptance of a “take it or leave it” proposal for a new 5+5-year contract term, even though 13 years remained on the original 25-year contract.

- Agreement on the contract was not agreed upon due to the “Termination of Convenience” clause on 1 Sept 2023.

Mas Awana Services Part of Malaysia Airlines

In 1997, Evergreen Revenue Sdn Bhd entered into a joint venture contract with Mas Catering (Sarawak) Sdn Bhd. This joint venture was initiated in response to the inability of the previous inflight and airport catering service provider at Kuching International Airport to meet contemporary airline catering standards. Concurrently, the proprietor of the previous catering company had been overseeing operations remotely from Australia. The joint venture successfully secured the necessary funding through the dedicated efforts of its directors, enabling the establishment of the Kuching facility.

In addition to Evergreen Revenue, the Sarawak state government, through the Sarawak Economic Development Corporation (SEDC), expressed a keen interest in participating in the joint venture with Mas Catering (Sarawak) Sdn Bhd. Evergreen Revenue held a strategic advantage, as its directors possessed extensive experience gained at Miri Airport, which was the second busiest airport in Malaysia at that time, primarily due to the flourishing oil and gas industry. Moreover, both directors were distinguished Sarawakian entrepreneurs of bumiputra origin.

During the 2000s, the joint venture involving Mas Catering (Sarawak) Sdn Bhd underwent a transformation, evolving into Mas Awana Service Sdn Bhd. The latter was once again called upon to provide assistance to Malaysia Airlines, given the high costs incurred from the then subcontracting catering services to Brahim’s at the KLIA Pan Pacific Hotel (now known as Sama Sama Hotel).

Resilient

The expenses associated with this arrangement were notably exorbitant. Nevertheless, Mas Awana managed to successfully reduce these costs by fifty percent while maintaining its own financial sustainability. The savings generated were instrumental in securing funding for the construction of the Salak Tinggi Mas Awana facility.

According to industry sources, it appears that Mas Awana demonstrated resilience by amassing a substantial profit margin, enabling it to weather the economic downturn induced by the COVID-19 pandemic. Notably, the company incurred losses estimated at RM30 million, particularly in its efforts to retain its workforce despite the marked reduction in the aviation sector activities.

As the contract for Golden Lounges management approached renewal in 2023, a competitive bidding process was orchestrated. Despite the intermittent developments during the bidding exercise, Mas Awana ultimately emerged as the recipient of the contract for the Satellite and Regional Golden Lounges.

And The ‘Bullying’ Continues …

Surprisingly the domestic Golden Lounges catering service have been awarded to Plaza Premium Group, as confirmed by industry sources. Plaza Premium secured the bid with an offer that far exceeds Mas Awana’s and also exceeded the rates charged by Mas Awana for the Satellite and Regional lounges.

There appears to be significant internal dissent within Malaysia Airlines over the decision to award the contract to Plaza Premium Group over Mas Awana. It’s worth noting that Mas Awana is majority-owned by Malaysia Airlines, and thus fully under its management and control and whatever income to be derived from the award of the contracts will also mean a significant stake will be returned to the airline group.

Plaza Premium Group, which is based in Hong Kong and owned by a non-bumiputra Malaysian Chinese, has a history of providing services to other airlines, including Cathay Pacific.

Interestingly, in 2023, Malaysia Airlines stopped using Plaza Premium Group in Melbourne, London, and Jeddah allegedly due to unsatisfactory performance and relatively high costs.

Blush Lounge

An interesting point for Plaza Premium Group is its operation of the Blush Lounge in London Heathrow. This lounge was previously known as the King David Lounge and served as the ‘Golden Lounge’ for El Al Israeli Airlines Ltd, the Israeli flag carrier.

Speculation is strive that following the termination of Plaza Premium’s contract at London Heathrow by Malaysia Airlines, Plaza Premium attempted to transfer the contract to Blush Lounge, which they operate. However, perhaps Malaysia Airlines will soon recognise the potential negative consequences in terms of branding and political ramifications if it shares a lounge with El Al Israeli Airlines Ltd.

Persistent rumours suggest that Malaysian intelligence authorities may have overlooked the fact that Plaza Premium Group, despite multiple terminations due to poor performance, is actively pursuing the Golden Lounge contract at KLIA.

It is widely known that Mas Awana continues to support Malaysia Airlines, particularly after the termination of the inflight meal contract with Brahim’s on 1 September 2023. And from that date hence, Malaysia Airlines commenced its inflight meal services from various tents and chilled portacabins on the KLIA tarmacs.

Mas Awana was entrusted with the task of sourcing meals from vendors and assembling them under the tents at KLIA, referred to as MCAT (Malaysia Airlines Catering). Words going around the airport is that this setup falls short of established airline catering standards and health authority requirements.

The Solution For Malaysia Airlines

To address this issue, Mas Awana proposed a solution to establish an exclusive facility for Malaysia Airlines Business Class outside of KLIA. They were given a tight deadline of only four weeks in October to set up this facility, with the first meal cart expected to roll out from the new facility by 1 November 2023, signifying a substantial effort to restore Malaysia Airlines’ brand and reputation.

NMH understands that despite providing a face-saving solution for Malaysia Airlines, Mas Awana faced challenges similar to those experienced by Brahim’s, including:

- Being instructed to give both Regional and Satellite Golden Lounge contracts to Plaza Premium Group without any tender or agreement by the board of directors at Mas Awana.

- The preference for Plaza Premium Group over Malaysia Airlines’ own subsidiary has raised questions about the influence of certain top management figures at MAB.

Questions Arise

Malaysia Airlines, via interviews with the Group CEO has expressed a need for partners, including foreign partners, for technical expertise and investment in their new “green field” airlines catering venture. This raises several questions:

a. Are these partners possibly Plaza Premium Group, given the favourable treatment they have received from Malaysia Airlines?

b. Why is Malaysia Airlines seeking new partners for technical know-how when they already have Brahim’s and Mas Awana, who have been longstanding providers of airline catering services for the past 20 years?

c. Concerns have been raised regarding the differential treatment of bumiputra partners compared to non-bumiputra and foreign-based partners with potential links to Israel and, by extension, Mossad and other Israeli intelligence agencies.

d. It is imperative to inquire whether the leadership of Malaysia Airlines has been influenced by Israeli elements or driven primarily by personal gain or financial interests at the expense of national interests. There are names being floated by many quarters who have demonstrated an obvious preference and bullying in their meetings and email instructions, but let’s leave that to the long arm of the authorities to investigate.

At Stake

What is at stake right now, in view of the escalating insurgencies in the Gaza Strip, is that Malaysia Airlines and the Malaysian government should be more cautious in its business undertaking.

It is time that the Ministry of Finance (MOF), Khazanah Nasional and the Ministry of Transport (MOT) are called upon to provide a response to the concerns raised by the Malaysian public regarding the treatment of bumiputra partners and the preference for a foreign vendor with a questionable performance record but apparent ties to El Al Israeli Airlines Ltd. – NMH

Datin Hasnah is the co-founder and CEO of New Malaysia Herald based in Kuala Lumpur, Malaysia.

With an extensive background in mass communication and journalism, she works on building up New Malaysia Herald and it’s partner sites. A tireless and passionate evangalist, she champions autism studies and support groups.

Datin Hasnah is also the Editor in Chief of New Malaysia Herald.

Facebook Comments