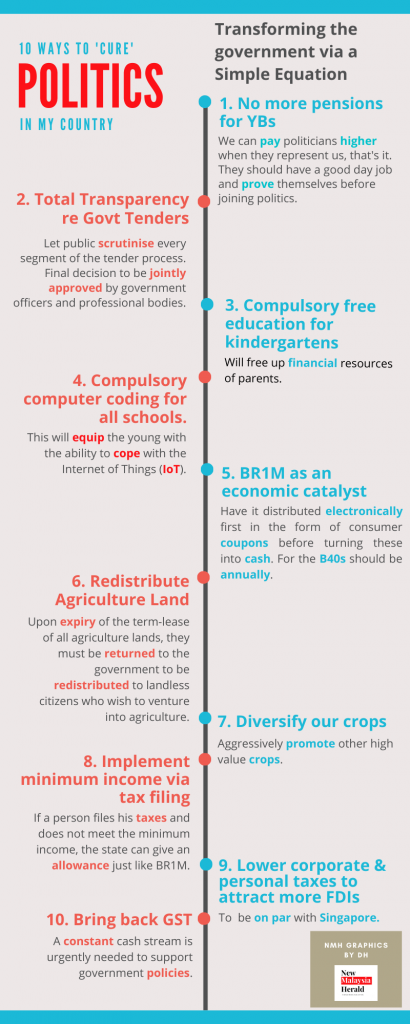

From getting rid of pensions for politicians, to bringing back the GST, Tzu Wong switches on the light bulb with his Simple Solutions via his Simple Equation column. We start with an infographic to whet your appetite.

Aren’t we tired of the crazy topics thrown at us by our politicians everyday? Especially during the last two years. If I were ever to go into public office, I would offer my constituents these 10 policies that I believe will transform our country and improve the livelihood of the people. This is beginning to sound like a manifesto, doesn’t it? And I feel as though I am hosting a political ceramah (*sniggers*).

Here goes, take it or leave it, these are just my thoughts :

Further Transform The Government

1. Get rid of all pensions for politicians. However, we can pay politicians higher when they represent us, and nothing more after they step down. They should have a good day job and prove themselves before they join politics, not the other way around.

2. Minimise corruption by putting all government tenders’ approving processes out in the open. We should allow scrutiny by the public in every segment of the decision process. Final decision should be jointly approved by government officers and professional bodies, and no one party should dominate the other party in the decisions.

Improve Education

3. Expand our compulsory free education to include pre-school and kindergartens. This will free up the financial resources of parents and will indirectly encourage population growth, which is one of the fundamentals for a healthy economy.

4. Introduce compulsory coding course in school to equip our people – especially the young – with the ability to deal with IoT (Internet of Things) in the new era.

Enhance Economy

5. BR1M as a catalyst for the economy. Provide BR1M on a regular annual basis for the B40s, but have it distributed electronically in the form of consumer coupons. If we are to give five billion BR1M coupons, we can structurally limit the coupons for a number of transactions before they can be redeemed for cash at the end of their cycles. These “helicopter money” can serve two purposes: help the people in the lower segment of our society and also force-generate multiplying effect on the economy. If we set a limit of 10 transactions for these coupons before it can be redeemed for cash, then we can ensure a multiplier of 10 on the value of the coupons. 50 billion economic transactions out of thin air, isn’t that nice?

6. Reshuffle social wealth via disallowing perpetual ownership of land. Currently, lots of lands are owned by big corporations and wealthy individuals. Perhaps one way to reshuffle social wealth (land should be considered as social wealth) is to forbid perpetual ownership of land. No more freehold agriculture land or continuous extension for those term-leased agriculture land. Upon the expiry of the term-lease of all agriculture lands, they must be returned to the government for it to redistribute these land parcels to landless citizens who wish to venture into agriculture. This should be done in accordance with the waiting list, of course. Whatever the previous owners have invested in the land can be compensated by the government at fair value and this cost can be passed on to the next owner. If this cost is too high for people to be able to afford, then this land can be acquired by the government GLCs or Foundations and income and profit from these government agencies can be used as a social safety net for the B40s.

7. Diversify our crops. Malaysia has the potential to grow many varieties of high value crops such as avocado, coconut, pepper, vanilla etc but so far oil palm is the only crop that is grown dominantly in the country. Besides wasting good agriculture land on a lower value crop like oil palm, the concentration of our resources in one crop is like putting all the eggs in one basket and making our economy vulnerable to outside factors. Hence, we should start a high value crop agency to aggressively promote, process, and market these crops for the benefit of our smallholder farmers.

Tax Reforms

8. Implement minimum wage through tax filling. If a person files his taxes and does not meet the minimum income, the state can give you an allowance to help you (just like BR1M). However, one must file their tax returns and be verified to qualify for this. This will improve our tax base and tax data and integrity and this will allow the Ministry of Finance to do a better and more effective financial planning for the country.

9. Gradually lower our corporate and personal taxes to be on par with our neighbour, Singapore. This will allow us to attract more FDIs and more opportunities for our economic growth.

10. Last, but not least, is the GST, stupid. Removing the GST and replacing it with SST was the worst thing the former government (PH) had done. This single policy did not just tailspin our government finances, it also created havoc in our economy and wasted hundreds of millions of funds from our private sectors, the most dumb decision ever, period. EVER.

![Difference Between SST & GST | SST vs GST in Malaysia [2020 Updated]](https://www.biztory.com.my/wp-content/uploads/2018/08/Screen-Shot-2018-08-23-at-17.48.47.png)

If you don’t like these pointers, please don’t shoot me, because like most of my fellow Sabahans, we have been over-consumed by Sabah politics just like how Isaac Newton was consumed, and later inspired by a fallen apple on his head. Peace ✌?.

Sometimes difficult problems can be solved by a Simple Equation, and you are welcome to add your suggestions in my facebook: https://www.facebook.com/tzu.p.wong. – New Malaysia Herald

New Malaysia Herald publishes articles, comments and posts from various contributors. We always welcome new content and write up. If you would like to contribute please contact us at : editor@newmalaysiaherald.com

Facebook Comments