How do you quantify the National Debt? – former premier asks DAP lawmaker

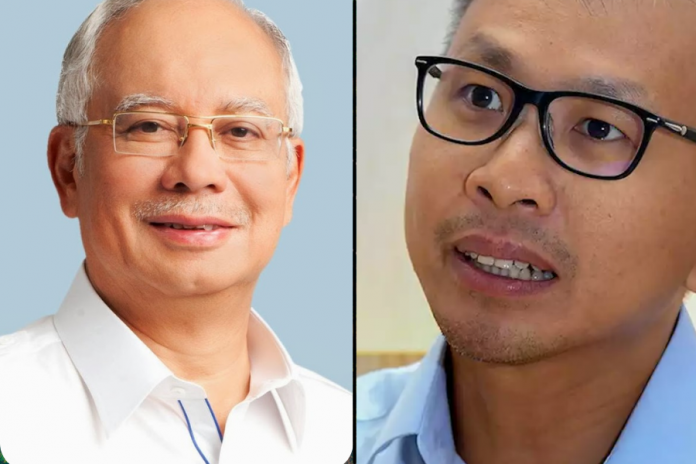

The country’s sixth prime minister Najib Razak today slammed DAP MP Tony Pua’s “emotional outburst” pointing out that Pakatan Harapan (PH) had changed the rules on counting national debt.

Najib, in his Facebook posting, questioned Tony Pua if a person would classify a guarantee given for a relative’s loan as one’s immediate payable debt.

“Would you also classify your future house rental payments as your debt? That is exactly what PH did when they tried to claim that the overall national debt had crossed RM1 trillion at the point of GE14.

“Unlike other governments around the world, including Singapore, the PH government tried to create an entirely new definition which included direct government debt, government guarantees and lease obligations.

“No one other than the PH government uses the definition that PH uses. It is just not internationally recognised and does not follow accounting standards,” Najib said taking a swift jab at the Damansara Parliamentarian.

Adding on further, the Pekan MP said, as explained numerous times before, all other countries in the world and the various international agencies classify government debt as only direct government debt and does not include the other two.

Najib also chided Pua by saying “no amount of emotional outburst and rude talking will mask the 22 months of failure under PH”, claiming that the government debt under PH had increased substantially during the time they were in office.

Najib criticism’s came after Tony Pua had responded to the former’s statement that the government’s direct national debt had now reached RM1 trillion, a far cry from when his administration headed the country. Tony Pua hit back by saying that the RM1 trillion debt was entirely that of Najib’s Barisan Nasional government.

In 2018, then finance minister Lim Guan Eng had claimed that the total amount of the government’s debt, including liabilities, amounted to more than RM1 trillion.

“RM80 billion in government guarantees for the various public transport projects are not included in the official government debt because infrastructures are long-living assets that continue to be useful 50 years and 100 years into the future.

“A tunnel, bridge or track line built today will still be functional decades into the future,” he said, quoting an article that said long-lived public infrastructure debt is not included as official government debt in Singapore.

“Government guarantees had increased by RM29 billion during the 22 months that the PH government was in office and by using Tony’s logic, should we also claim that the PH government had also tried to ‘hide’ RM29 billion in debts?” he questioned.

Najib also accused the PH government of having raided Petronas “to pay insanely high dividends” of RM24 billion in 2018 and RM54 billion in 2019, much higher than the RM16 billion paid to the BN government in the previous two years.

“If Petronas did not pay these dividends which are recognised as government revenues. the PH government’s deficit and increase in debt would have been even higher,” he said.

Cash Reserves

“Under my watch Petronas cash reserves had increased from RM30 billion in 2008 to RM176 billion at the point of GE14 – only to be raided by PH. Here’s the financial statement as at Q2 2018. Not only Petronas was made to pay but Khazanah Nasional too.

“During my time in office and as Khazanah Chairman, Khazanah Nasional’s net assets had grown from RM33 billion to RM116 billion. However due to huge sell-offs of Khazanah’s assets since 2018 (which Tony then claimed was “liquidating”), its net assets dropped to RM81 billion in 2019 – a decrease of RM35 billion.

“Please don’t try to use 1MDB as an excuse as not a single sen of 1MDB’s principle debt of RM32 billion was reduced during the entire time that PH (and PN) was in office,” Najib pointed out.

He added that PH did not understand debt management, “which is why they failed so badly in economic management and efforts to promote growth when in power,” he said.

Meanwhile, writer Joe Fernandez said that debts are not an issue as long as the gov’t is willing and able to pay and these are sourced domestically.

“Malaysia’s national debts can safely be even 100 per cent of GDP, 150 per cent or even 200 per cent. There are safe limits. At one time, Singapore’s National Debt was 200 per cent of GDP, Japan’s was 400 per cent.

“National debts are an important investment avenue for domestic institutions. The EPF for example, by law, can lend 30 per cent of its funds to the gov’t.

“Gov’t must also first borrow from EPF before turning elsewhere. Gov’t borrowing from EPF helps the Fund to maintain dividends at a reasonable rate.

“Greece collapsed financially, at one time, after the Opposition came to power because it told the people that the gov’t can no longer repay national debts.

“That’s not economics but politics,” Joe added

He pointed out that public and investor confidence and the confidence of the financial community in the Greek gov’t evaporated overnight.

Greece had to turn to Germany and the EU, among others.

The rest is history.

No gov’t in the world will go bankrupt. After GE14, LGE undermined confidence in the gov’t, the economy and the people by misleading the people on the national debt.

Confidence Shaken

Politics have no place in maintaining confidence in the gov’t and economy.

Confidence can be likened to a flock of birds feeding on the grains that we throw on the ground. If anything scares them, i.e. their confidence is shaken, they will immediately take flight, first to the nearest telephone poles carrying the wires, then far away, never to come back for a very long time. It takes a long time for confidence to return. Confidence is like a bubble.

Joe added that even a bad gov’t is better than no gov’t at all. LGE, who lied to the people of Sabah and Sarawak to win GE14, forgot about confidence in his attempts to tarnish Najib and the BN.

The result is what we see today. – New Malaysia Herald

New Malaysia Herald publishes articles, comments and posts from various contributors. We always welcome new content and write up. If you would like to contribute please contact us at : editor@newmalaysiaherald.com

Facebook Comments